A blog by Kris Jones

The recent visit to Belfast by President Biden and US Special Envoy Joe Kennedy helped highlight the dynamic nature of the Northern Irish economy and particularly the tech and startup scene. They followed in the footsteps of Raise Ventures by holding their keynote event at the new Ulster University Campus.

The Raise Sunset Pitch event at UU saw 5 fast growing tech companies pitch to a room of over 60 angel investors, following completion of the Raise investor readiness programme. The hands-on programme led the founders through their fundraising strategy, pitch, data room and provided an independent report on their investor readiness.

This has been followed by positive initiatives by Ormeau Baths, who will be hosting Investors Sprints for selected founders, an expected announcement on a British Business Bank backed startup investment fund and open applications for Catalyst’s Invent. The Raise team also visited Queen's University to watch the graduate startups in their recent Dragon's Den pitching competition.

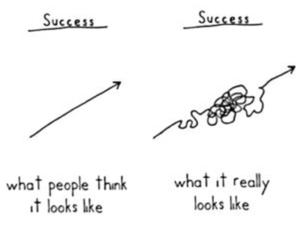

What we are seeing locally is no let up in the levels of ambition and innovation. We would argue that it’s never been easy for NI founders to access venture capital and they have always had to work very hard to get themselves in a position to be investor ready and work even harder to get the money in. This isn’t going to change, but we would argue the resilience engrained in NI founders will allow good startups to raise.

It’s worth reviewing the bigger picture.

So we’re noticing some themes in the as we’ve moved past the first quarter of 2023.

VC’s are lacking conviction, need more convincing to part with cash, which leaves this continuance of a void, particularly at the top of the funding funnel (see what I did there!).

VC’s are apparently sat with a ton of dry powder, but are being a hell of a lot more picky over the deals they’re presented with in the first quarter, and that trend doesn’t seem likely to end any time soon.

In some cases they’re worried about the portfolio companies that are sat in their existing funds & working out whether to stick or twist. Every stage of fund or investor is also raising the bar in terms of traction, execution and conviction before they’ll invest, even at pre-seed.

In the UK there are a hardy bunch of around 20-25 funds that are writing cheques, but they can’t possibly service the entire market as most of them only make around 10-15 bets each in a year (you can do the maths on that one yourself).

Factor in the cost of living pinch, the bath investors have had to take on housing valuations (which form at least part of the portfolio of most investors), and the overall economic uncertainty globally, and you’re not seeing many Angels deploy either.

Angel syndicates are looking for more certainty in their deal flow too, and are passing over pre-seed stage deals in favour of seed rounds or at the very lowest bridging rounds for companies well on the way to Product Market Fit.

What does this mean for startups?

Well, you’re not going to like this, but I’m going to try and shit sandwich it.

- On the one hand, it means that if you can get a strong proof of concept and early traction, even if you don’t get investment, you’re well on the way to organically funding your growth.

- If you really can’t scale or grow without cash and can’t see your path to growing revenue and building profitability at an early stage, you should probably go do something else or wait out the storm.

- There’s money around if you can get to strong indicators of Product Market Fit.

More shit than sandwich if you were expecting good news on the investment front, but nonetheless it’s an accurate state of affairs based on the interactions I have with hundreds of startups and investors I get each week.

In a lot of cases from an investor perspective, they’re really gutted they have to pass on some deals, but they literally are being able to pick from a LOT of strong propositions.

The key takeaway from that is, don’t be disheartened, you’re just in a more competitive environment than there has been for a decade and the startups who do grow from this period will be the ones that exit for a ton of cash and live long in the memory.

Another good piece of news that’s more anecdotal is that we’re seeing more operator/founders getting involved at pre-seed stage collectively putting cheques into early stage startups.

Angels do exist out there, but you have to work hard to build relationships with them and find them.

I don’t own a crystal ball, but I can definitely fast forward five years in my head and see a lot of ‘I told you so’ posts on LinkedIn (or whatever we’re using then).

So what do you do about it?

- Build in public

- Build relationships (even if you don’t get investment, you’ll learn a ton and build a bigger, better network)

- Build your case (if you’re really hell bent on investment right now or can you build a bit more traction, do you have evidence and data to back up your vision and have you completed an investor readiness report?)

- Build your business - even if you’re a company that would traditionally have had a longer cycle to commercialisation, think about what you could commercialise early to get some proof of concept and revenues

Building in public will mean that people get more of a chance to get visibility of what you’re doing, for who and most importantly, why.

Build relationships with potential investors and partners. Don’t rush into asking for investment. Building a bigger, better network is never a waste and some of these people may be customers or may open doors for you even if they don’t invest in you themselves. You can’t build a value proposition by trying to take straight away, try and give.

By focusing on building an investment case through growth, traction and momentum, then even if investment doesn’t happen, you’ve got plenty to keep you busy. Keep interested parties up to date with your progress and sure enough they’ll come to you if they’re sufficiently impressed with what you’re doing.

By focusing on building a business first, you’re putting strong foundations in that may mean you won’t need investment to get to product market fit and that you’re really thinking about your business (and then most importantly) your customers.

I’ve been learning this the hard way myself as founder of Magic Sauce, and seeing the journey of many, many founders that have launched businesses in the last two years.

The landscape is changing, and you can adapt/survive or wait/perish

If you’re at a crossroads and don’t know what to do, or need a steer then try and get yourself onto an accelerator programme that can help you navigate to a strong proof of concept and give you the advice you need to kick start your dream. Co-working is another great route, being surrounded by peers so you can share your journey.

Build that network out by being visible. Nobody knows if you’re waving or drowning until you’re close enough to see.

Work out how you can build either an offline proof of concept or low-tech proof of concept that you can build yourself.

Use that network to find co-founders or early partners that can help you get over these first few hurdles.

Do what you need to do to keep the lights on and eat too. We’ve seen some great examples of startup founders adapting by solving another problem for their target audience (based on their marketing/sales/tech skills) to build relationships while they build out the core of the solution that can really scale and solve bigger headaches.

Remember, I’ve been there. I’ve raised before, succeeded before and failed before. Just get the fundamentals right.

Are you solving a problem that people will pay to have taken away?

Can you build an early solution that can validate that hypothesis?

Can you put in the hours to build it?

Hopefully that’s of use, and you’ll find me mentoring startups at Raise Ventures, Black Valley, Carbon13 and as head of Founder Education at Diversity-X. They all provide a great launch pad for your career as a founder, so definitely check them out.

Kris Jones is founder of Magic Sauce, a platform trying to reduce friction between founders & investors while elevating underestimated founders globally.

Member discussion