The big question of “will there continue to be an Invest NI?” has been answered. There will be. However, it’s likely to look very different from the agency as it stands today following the Independent Review published on 11th January 2023. The review panel, chaired by Sir Michael Lyons and comprising Dame Rotha Johnston DBE and Maureen O’Reilly, came to some very stark conclusions on how Invest NI operates, its myopic focus on a small number of large companies and its future focus.

Quite often overlooked and under-supported, for those of us in the startup sector the Independent Review reflects the under-representation of startups as a focus at Invest NI, an undefined group that sits in the territory between Entrepreneurship and SMEs with relatively few references in the report. There is, however, recognition that this is one of the many things within Invest NI that needs fast and radical change.

Here we’ve taken a look at the impact the findings of the report poses for startups, answering three key questions:

What is the impact on the funding landscape for startups?

What does it mean for accelerators and entrepreneurial programmes?

Where does this leave startups?

Will the Invest NI backed venture funds continue?

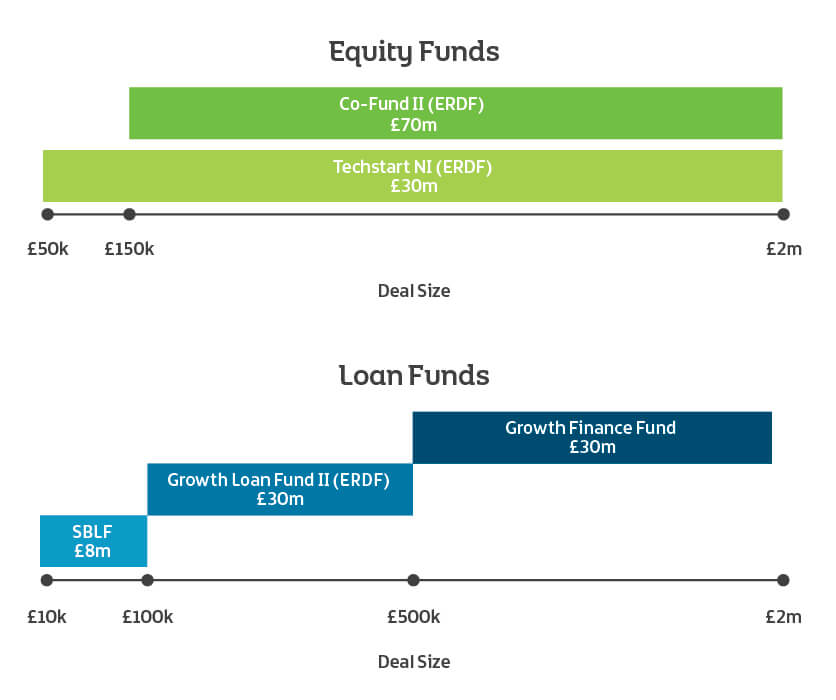

Under the Access to Finance initiative, Invest NI set out to provide an innovation escalator whereby high growth potential companies could be funded via various funding bodies with a funding pot equating to almost £170m as shown below.

Under this umbrella were various funds:

- The NISPO (Northern Ireland Spin Out) funds such as E-Synergy and Techstart for early stage technology-focused startups.

- The Clarendon Co-Fund was designed to co-invest alongside private sector investments in various companies.

- Crescent Capital to provide later stage Seed to Series A stage funding and innovation loans for companies in the scale up category.

Most of the above were funded by the European Regional Development Fund (ERDF), a casualty of Brexit which is yet to be replaced as highlighted by the Independent Review. While there is a suggestion that the ERDF funding may be replaced by Leveling Up funding and other pots from the public purse, the review is at best non-committal on the chances of this occurring. There is apparent doubt about the ability of these funds to continue.

This may well be due to the collapse of almost a quarter of the funds and the reported poor performance of the Invest NI funding initiatives in terms of return on investment. The report highlights that the Techstart II fund returned only 0.25p per £1 invested - the poorest performing of all the funding initiatives in the report.

The E-Synergy fund collapsed in a legal blizzard in 2017 as covered by the BBC here while Crescent Capital also failed to raise the capital for the Crescent Capital IV fund effectively collapsing it also. Invest NI also announced that there would be a review of an earlier Crescent Capital fund as detailed in the Irish News here.

While it no longer appears as part of Invest NI’s Access to Finance initiative, Crescent Capital may well have a second life yet as the former MLA and Lord Mayor of Belfast Máirtín Ó Muilleoir is working with the vehicle to raise a new fund in the US and beyond. There is also talk of a new £70m equity fund via the British Business Bank not to mention the presence of hugely successful private funds such as Cordovan Capital and Sam Rusk’s Endeavour Investments. A very different environment from the one in 2010 when Invest NI launched its funds to address the market failure in venture capital in Northern Ireland.

What is clear is that Invest NI is to open up and provide a signposting service for sources of finance other than its own which will be a very welcome change for angel investors, family offices and private funds that have found it difficult to be seen and heard since 2010 due to Invest NI’s much enhanced profile and larger marketing machine, not to mention finding it all but impossible to compete with funds that are not incentivised to return money and in fact can lose money at a rate that would be devastating to private funds and a career ender for their fund managers.

The report states:

“We are therefore of the view that it is crucial that Invest NI develops its role as a guide to alternative sources of finance and support, ensuring that it focuses on where it can add value by complementing or enhancing support available through other bodies. With this in mind, we conclude that Invest NI must ensure that it has full understanding of all the available funding avenues and criteria, becoming a centre of information and guidance, so that it effectively and strategically collaborates with delivery partners to achieve the maximum impact on the NI economy.”

There have been many people calling for the Invest NI backed funds to fall in behind private sector funders and investors rather than directly competing with them in deals and it looks like the above might see a mindset shift towards that approach, which would be most welcome. However there is also a recommendation that “Consideration should be given by Invest NI to enhance and increase the current offer of equity and repayable type loans, including that offered to start-up companies” which may see the likes of Techstart retained and refunded despite their poor commercial performance.

For startups unfortunately the funding landscape in the short term in Northern Ireland is likely to become more obscure, which isn’t great timing given that we are entering what looks like it might be a deep recession. This may represent an opportunity for private capital, however, to make deals while Invest NI restructures which is likely to take significant time.

What does the review mean for accelerators and entrepreneur facing programmes?

You may be aware that Invest NI previously funded a number of accelerator programmes between 2010 and 2022, amongst them StartPlanet, Propel and Ignite. These programmes were structured much like the traditional private sector model of a Y Combinator or Dogpatch Labs whereby the companies were offered some upfront funding combined with a growth programme intended to take them to investor readiness on completion.

By the numbers, the Ignite NI programme in particular was a success with many entrepreneurs going on to raise significant capital following the programme. Despite this, the programme was discontinued in 2022 - a victim of the budget cuts that Invest NI suffered as a result of Brexit (in particular the loss of ERDF funding), the COVID-19 pandemic and other factors such as the instability of the Northern Ireland executive.

However, the Independent Report paints a slightly different picture that suggests there wasn’t any real appraisal of the effectiveness of the programmes which were instead cut as a result of Invest NI’s ability to take advantage of contractual break clauses, evidenced by the fact that they handed back almost £10m of unused funds to the department in the same year. The report says:

"We were also concerned to note that within the context of this prioritisation exercise, some programmes that had received positive evaluations, were strongly supported by DfE, and which stakeholders described as effective and valuable, such as Ignite, the Propel Pre-Accelerator and HBAN (Halo Angel Business Network), were deprioritised or withdrawn entirely, further weakening the agency’s support for start- up and early-stage companies.

"In these cases, Invest NI has acknowledged that the decision to terminate these contracts, in response to budgetary pressures, was mainly based on the ability to take advantage of the flexibility of a break in contract and on the view that there were some other programmes in this space available in the market. Invest NI also acknowledged that whilst Ignite and the Propel Accelerator had a low return on investment to date, the evaluations indicated that there were significant returns on existing investment that had not yet accrued. It is our view that this decision was short-sighted, in particular given that Invest NI has since surrendered just over £10m back to the Department in this financial year."

Considering that two thirds of Invest NI’s budget was allocated to only 10 large companies in the last five years, this shows a callous lack of regard for the startup sector and its importance in the future economy of Northern Ireland. If reversing the brain drain and supporting our native entrepreneurs are not major tenets of the 10X economic strategy then what is?

It’s a fairly damning conclusion that Invest NI have been effectively held to ransom by a cabal of large employers who have held the ‘pay us or we leave’ Sword of Damocles over their heads successfully for a very long time.

In July 2022 Invest NI announced it was re-entering the accelerator space in partnership with Techstart Ventures via the Ormeau Labs project to be hosted at Ormeau Baths. Despite the initiative being due to commence in October 2022, as of January in 2023 it has yet to launch.

Where does this leave us in the startup sector?

It may well be that for the foreseeable future we need to fend for ourselves as any root and branch reform of a large public sector organisation is going to take significant time. However, if it is the case that we’re entering a period of reduced or removed support from our economic agency then we should be united, prepared and visible for when Invest NI does return in whatever form and we should be crystal clear about what we need it to do to help us succeed. Invest NI has taken a leadership position in the startup sector with a number of interventions in the past decade and a bit and as published in the Independent Review most have been short term and inadequate in impact.

The next big question won’t be should there be an Invest NI but rather what should the new Invest NI be? We may never have a better opportunity to shape that outcome than the one we have right now.

About Raise

Raise Ventures are a commercial startup accelerator supporting early-stage Northern Irish, Irish and UK tech companies. Created for founders, by founders, we pride ourselves on being a leader in the startup space within Northern Ireland and a companion on the journey of entrepreneurship.

We nurture high potential, disruptive and scalable ideas to create investable enterprises through our Accelerator programme, community and open pitch events.

Our portfolio has grown to 18 active companies over 3 years, 8 of which have raised early stage investment totalling over £2 million - a significant amount of early stage cheques.

We operate across industries including insurance, cybersecurity, healthtech, recruitment, finance and the creative sector. From 2019, Raise pitch events have given over 50 startups a platform to pitch and connect with local and international angel investors and venture capital funds. These startups have gone on to raise over £36 million in pre-seed and seed funding.

Applications are open now for our Spring Raise Accelerator Programme and the door is always open to investors looking for excellent early stage investment opportunities.

Let’s continue the conversation to help create the next generation of successful tech companies. Please leave your comments below.

Member discussion